Is a Rubber Powder Production Line Profitable in 2025? A Complete ROI Analysis Guide

Each year, over a billion scrap tires are discarded globally, and this challenge is rapidly transforming into a lucrative business opportunity: turning waste tires into valuable “black gold.” Many savvy investors have taken notice of this sector, but a core question often causes hesitation: what is the true profitability of investing in a waste tire recycling line?

Online information is often fragmented and lacks transparency, making an accurate assessment difficult. This guide cuts through the noise. We will provide a clear, step-by-step framework to help you precisely analyze the Return on Investment (ROI) for your project, empowering you to make a smart, data-driven investment.

The Foundation of ROI: Deconstructing the Tire Recycling Business Model

To calculate your return, you must first understand the core business model. It’s a straightforward process following the classic “Input-Transformation-Output” logic.

Input: A Stable Supply of Raw Material

The process starts with sourcing a steady supply of end-of-life tires from sources like tire shops, auto repair centers, fleet operators, and professional scrap collectors.

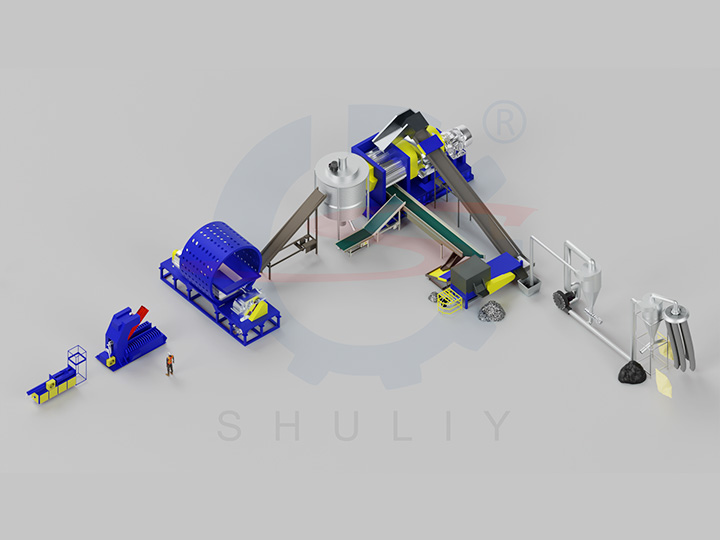

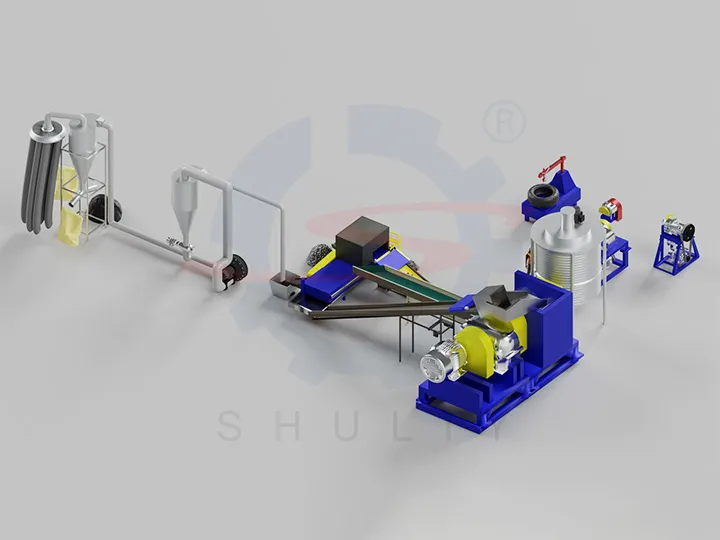

Transformation: Automated Shredding, Grinding, and Separation

his is the value-creation engine of your tire recycling business. Whole tires are fed into an automated production line, undergoing a series of processes including de-beading, shredding, magnetic separation, grinding, screening, and air classification. A modern rubber powder production line executes this conversion with incredible efficiency.

Output: Three Core Revenue Streams

After transformation, the value of a single waste tire is fully unlocked, yielding three sellable commodities:

- High-Value Rubber Powder/Granules: The primary source of income, used in modified asphalt, waterproof membranes, rubber flooring, sports tracks, and more.

- Sellable Steel Wire: The steel is cleanly separated and sold as high-quality scrap metal to steel mills or recyclers.

- Alternative Fuel or Industrial Feedstock: The separated nylon and fiber can be sold as Tire-Derived Fuel (TDF) for industrial kilns.

Breaking Down Costs: Your Capital (CAPEX) vs. Operating (OPEX) Expenditures

Your total project cost is comprised of one-time initial investments and ongoing operational expenses.

Capital Expenditure (CAPEX) – Your One-Time Investment

Equipment Investment: The core of your CAPEX, the cost of a complete automatic rubber powder production line, varies significantly based on its processing capacity (e.g., a 2-3 TPH line vs. an 8-10 TPH line). (Interested in the specific configurations and technical advantages of different capacity lines? Explore our Full Automatic Tire Recycling Line product page)

Operating Expenditure (OPEX) – Your Monthly Overhead

Electricity Costs: This is typically the largest single operating cost. The high-power tire shredders and rubber mills are significant energy consumers. Therefore, choosing energy-efficient equipment is critical to controlling OPEX and maximizing profits.

Labor Costs: Modern, highly automated lines require minimal staff, typically 3-5 workers to manage feeding, system monitoring, and product bagging.

Maintenance & Spares: This includes routine lubrication and the cost of replacing wear parts like shredder blades. Partnering with a supplier that offers durable, low-cost spare parts is key.

Logistics & Other: Costs for raw material transportation and storage of final products.

Quantifying Your Revenue Streams

After costs, let’s look at the income side.

Primary Revenue Stream: High-Value Rubber Powder

The market price for rubber powder is driven by its fineness (mesh size), purity, and market demand. Generally, finer and purer powder commands a higher price.

Ancillary Revenue Streams: The Value of Byproducts

Newcomers often focus only on the rubber powder, but the byproducts offer significant, consistent revenue that boosts overall profitability.

- Recovered Steel Wire: As high-quality scrap metal, its market price is very stable.

- Nylon/Fiber: As an alternative fuel (TDF), it provides an additional income stream and solves a waste disposal issue.

Beyond the Numbers: The Key Levers to Maximize Your ROI

While every project’s specific numbers will differ, the levers for maximizing profitability are universal. Understanding them is key to building a successful business.

Lever 1: Equipment Efficiency

As noted, electricity is a major operating cost. A tire rubber powder machine that is 33% more energy-efficient directly translates into significant annual savings, which drop straight to your bottom line.

Lever 2: Purity of End Products

A well-designed rubber powder production line with superior separation systems (magnetic and air classification) yields cleaner rubber powder and steel. High-purity products can fetch a 5-10% price premium in the market, directly increasing your total revenue.

Lever 3: Level of Automation

With labor costs rising globally, a highly automated rubber granules production plant hedges against future risk and ensures a long-term competitive cost advantage.

Conclusion: Is Investing in a Rubber Tire Recycling Line the Right Choice for You?

The answer is a resounding yes—provided you plan meticulously and choose the right technology partner. Waste tire recycling is a high-potential, sustainable industry. By accurately forecasting costs and revenues, and by selecting efficient, reliable rubber powder production equipment, investors can achieve a substantial and rapid return on investment.